Which Motor Fuel Tax

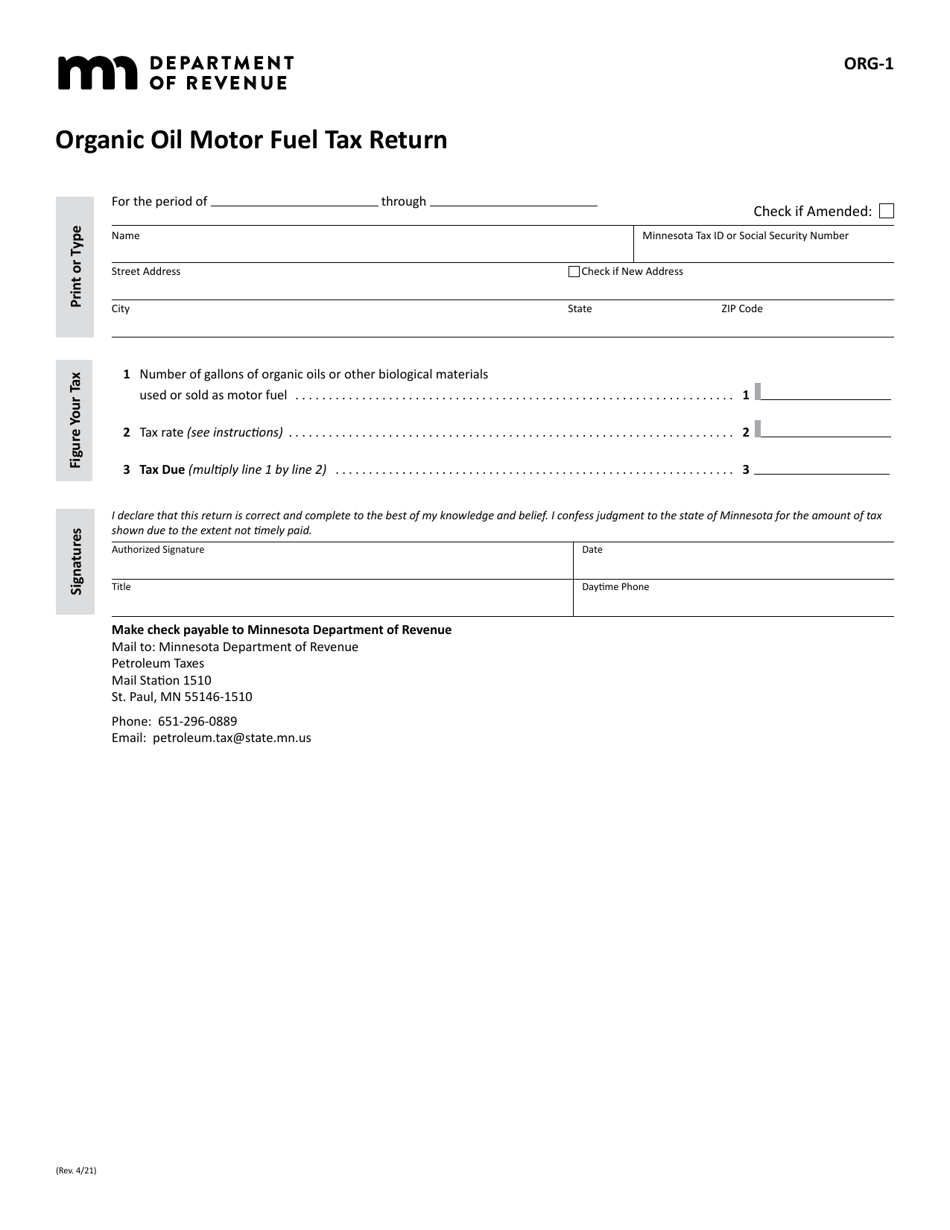

Which Motor Fuel Tax. Taxpayers may qualify for different types of motor fuel tax refunds. Motor fuel tax and carbon tax apply when you purchase or use fuel such as gasoline, diesel and propane, unless a specific exemption applies.

Disposition of State Motor Fuel Tax Receipts Tax Policy from www.taxpolicycenter.org

Disposition of State Motor Fuel Tax Receipts Tax Policy from www.taxpolicycenter.orgRemoved from a terminal licensed with the internal revenue service. Motor vehicle fuel tax (gasoline and gasohol) a motor vehicle fuel tax of $0.23 cents per gallon is imposed on motor vehicle fuel sold to retailers and consumers. Motor fuel cannot be purchased tax free using an ag/timber number.

Motor fuel cannot be purchased tax free using an ag/timber number. By law, the fuel tax payments must be remitted via electronic funds transfer (eft).

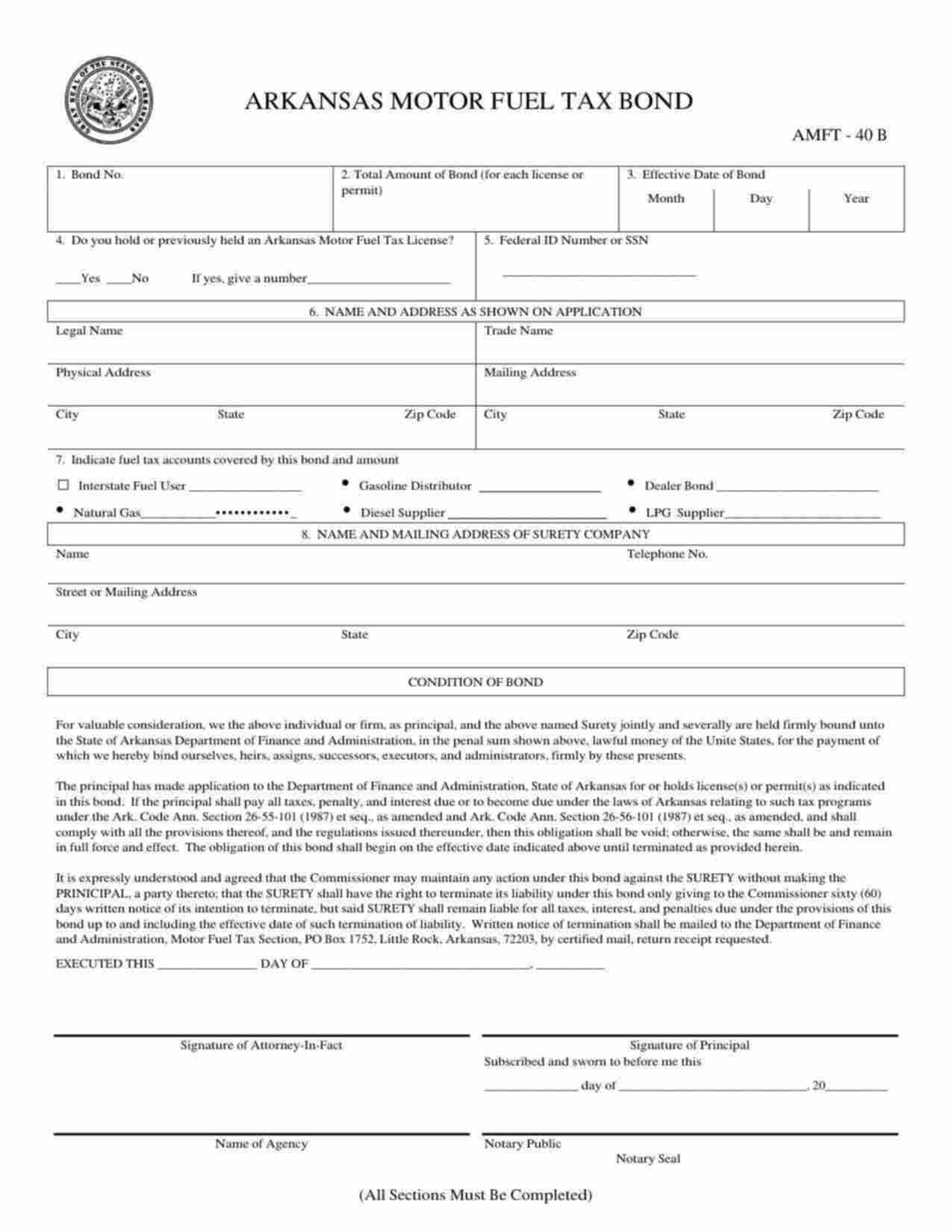

For example, the state of illinois charges 10% of the total tax due or $50, whichever is greater, for tax underpayments, and can charge an additional 20% if the act is deemed negligent. The arkansas motor fuel tax section administers the interpretation, collection and enforcement of the arkansas motor fuel tax laws.

There are two types of vehicle fuel tax accounts: From july 1, 2021, through june 30, 2022, the rates are as follows:

Motor fuel tax rates are expected to change jan. The nebraska motor fuels tax rate for jan.

The current federal motor fuel tax rates are: Upload, edit & sign pdf documents online.

$0.219 / gallon* *most jet fuel that is used in commercial transportation is.044/gallon Licensed motor vehicle fuel suppliers pay the tax based on (1) terminal receipts (withdrawals by suppliers from a wisconsin pipeline terminal when metered out at the terminal rack) or (2) imports of motor vehicle fuel into wisconsin by means other than pipeline and marine vessel destined for terminal storage [secs.

Motor fuel tax and carbon tax publications. On this publications page, you will find notices , bulletins , other web resources and legislation that relate to motor fuel tax (mft) and carbon tax (ct).

These payments must be filed and completed before 4:00 p.m. The current motor fuel tax rate as of 10/04/2021 is $.34 per gallon.

In states where taxes vary depending upon the price of the motor fuel (for example, where the tax rate is set as a percentage of the sales price rather than a cents per gallon method), the state average listed on the chart is a snapshot based upon the price of fuel (as reported by aaa) on the date the chart is updated. There is no refund of the lust tax.

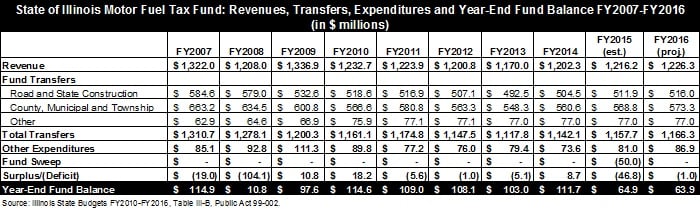

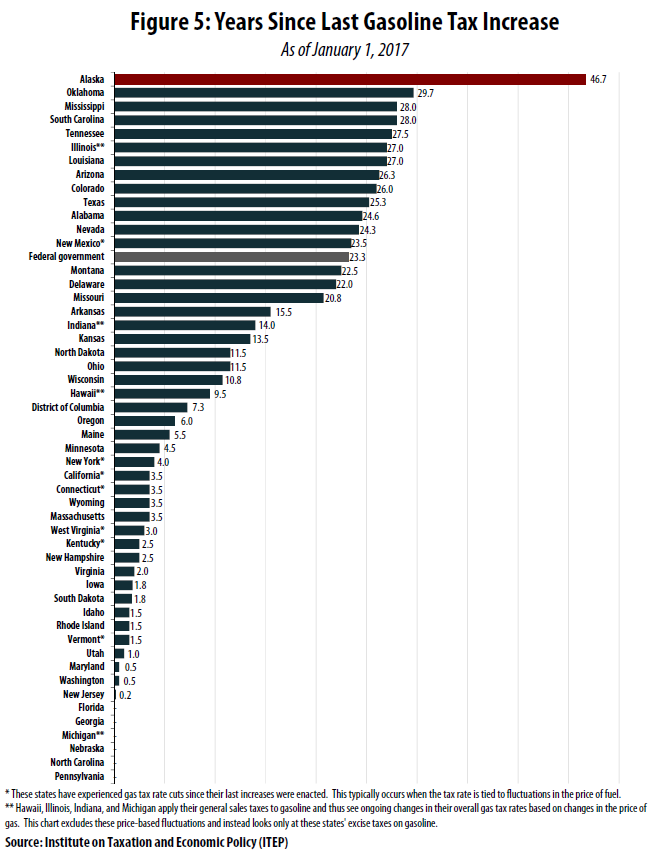

Product rate cents per/gal gasoline $.184 18.4 cpg A critical system at risk 5 the problem is further compounded by a clear reluctance on the part of elected officials to increase tax rates, motor fuel or otherwise.

The price paid at the pump includes motor fuel taxes. It is paid by distributors and suppliers who collect the tax from their customers.

The current federal motor fuel tax rates are: Consumers who use motor vehicle fuel for an industrial purpose may obtain a partial refund of 22½ cents per gallon.

Ad single place to edit, collaborate, store, search, and audit pdf documents. 1 through june 30, 2022, will be 24.8 cents per gallon, down from 27.7 cents per gallon.

1, 2022, dropping to 24.8 cents per gallon. Start 30 days free trial!

Motor fuel tax and carbon tax apply when you purchase or use fuel such as gasoline, diesel and propane, unless a specific exemption applies. Ad single place to edit, collaborate, store, search, and audit pdf documents.

In states where taxes vary depending upon the price of the motor fuel (for example, where the tax rate is set as a percentage of the sales price rather than a cents per gallon method), the state average listed on the chart is a snapshot based upon the price of fuel (as reported by aaa) on the date the chart is updated. Ad single place to edit, collaborate, store, search, and audit pdf documents.

The federal gas tax has been set at $0.184 per gallon (higher for diesel) for more than two decades. Upload, edit & sign pdf documents online.

Motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). Ad single place to edit, collaborate, store, search, and audit pdf documents.

Motor fuel tax rates are expected to change jan. There are two types of vehicle fuel tax accounts:

The arkansas motor fuel tax section administers the interpretation, collection and enforcement of the arkansas motor fuel tax laws. 1, 2022, dropping to 24.8 cents per gallon.

The Motor Fuel Tax Is Imposed On The Privilege Of Operating Motor Vehicles On Public Highways And Recreational Watercraft On Waterways In Illinois.Start 30 days free trial! Most states levy per unit taxes based on how many gallons of gasoline a consumer purchases. Gasoline cannot be purchased tax free;

The Current Motor Fuel Tax Rate As Of 10/04/2021 Is $.34 Per Gallon.A refund claim must be. Motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). A critical system at risk 5 the problem is further compounded by a clear reluctance on the part of elected officials to increase tax rates, motor fuel or otherwise.

These Payments Must Be Filed And Completed Before 4:00 P.m.Motor fuels and alternative fuels tax rate from july 1, 2014 through december 31, 2014 On the flip side, overpayment of tax liability lowers cash flow and reduces profits. Licensed motor vehicle fuel suppliers pay the tax based on (1) terminal receipts (withdrawals by suppliers from a wisconsin pipeline terminal when metered out at the terminal rack) or (2) imports of motor vehicle fuel into wisconsin by means other than pipeline and marine vessel destined for terminal storage [secs.

Ad Single Place To Edit, Collaborate, Store, Search, And Audit Pdf Documents.Taxpayers may qualify for different types of motor fuel tax refunds. 1 through june 30, 2022, will be 24.8 cents per gallon, down from 27.7 cents per gallon. Missouri receives fuel tax of 17 cents a gallon on motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis.

Ad Single Place To Edit, Collaborate, Store, Search, And Audit Pdf Documents.Motor vehicle fuel includes gasoline and gasohol. Upload, edit & sign pdf documents online. The motor vehicle fuel tax and diesel fuel tax are imposed on each gallon of fuel entered, or removed from a refinery or terminal rack in this state.

Belum ada Komentar untuk "Which Motor Fuel Tax"

Posting Komentar